Slotbox Casino Login and Registration

Getting started at Slotbox Casino is quick and straightforward. To create an account, simply visit the Slotbox Casino website and locate the “Sign Up” or “Register” button, usually situated at the top-right corner of the homepage.

After clicking this button, you’ll be directed to an online form. Here’s what you’ll need to do in short:

- Fill out basic information like your name, email, and date of birth.

- Create a unique username and a secure password.

- Confirm your registration via a verification email.

Once you’ve clicked on the verification link in the email, your account will be activated. You can then log in by clicking the “Login” button and entering your username and password.

Remember, before you can make a withdrawal, you’ll need to complete the account verification process. This involves uploading documents such as your passport or a utility bill via your account profile.

And there you have it! You’re now set to enjoy everything Slotbox Casino offers, from its extensive game selection to its secure and quick banking options.

Slotbox Casino Promotions and Bonuses

Slotbox Casino keeps the excitement level high with a range of promotions and bonuses designed to enhance your gaming experience. From welcome bonuses to weekly promotions, there’s always something extra waiting for you:

- Attractive welcome bonuses for new players to kick-start their gaming journey.

- Regular promotions including free spins, reload bonuses, and cashback offers.

- Special events and seasonal promotions for added excitement.

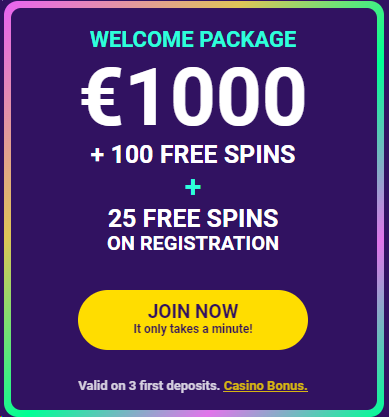

Slotbox Casino Welcome Bonus

New to Slotbox Casino? You’re in for a treat! The platform offers a robust welcome package that can provide up to €1,000 in bonuses and an additional 100 Free Spins. This package is specially designed to reward you on your first three deposits, giving you extra incentives to explore the wide array of games on offer.

Details of the Welcome Package:

- 1st Deposit Offer: Get a 100% match bonus up to €100, plus 100 Free Spins.

- 2nd Deposit Offer: Secure a 50% match bonus up to €200.

- 3rd Deposit Offer: Receive a 25% deposit boost up to a whopping €700.

To take advantage of these exciting offers, make sure to opt in for marketing communications. This ensures you’ll receive exclusive promotions directly to your inbox.

Don’t miss out on this generous welcome package. Make your first deposit today to start your Slotbox Casino adventure with a bang!

Slotbox Casino Birthday Bonus

If you’re an Irish player looking to celebrate your birthday in style, Slotbox Casino has a special treat for you. However, this birthday bonus comes with a twist—it’s an exclusive feature of the Slotbox Casino VIP program.

Key Features of the VIP Birthday Bonus:

- VIP Only: This bonus is specifically tailored for VIP members.

- Point Accumulation: To qualify, you must have at least 5,000 points in your VIP program account.

- Varied Offers: The birthday bonus can include diverse rewards like free spins, cashback, or other exclusive perks.

To become eligible for this unique birthday bonus, you’ll need to actively participate in Slotbox Casino’s gaming platform and accrue enough points to reach VIP status. Once you’re a VIP member with the required number of points, you can look forward to an extra special birthday celebration courtesy of Slotbox Casino.

Loyalty Bonuses at Slotbox Casino

Slotbox Casino offers a comprehensive loyalty program designed to reward your continuous play. Known as the SlotClub, this program includes seven distinct levels, making it accessible for both casual players and high rollers alike.

How It Works:

Simply engage in your favorite games and you’ll begin to accumulate points. The more points you earn, the higher your SlotClub level will be, which unlocks better rewards and exclusive perks.

LevelUp Rewards

When you reach a new level within the SlotClub, you immediately unlock a LevelUp Reward. These rewards vary but can include free spins, super spins, and bonus cash.

Monthly Reloads

The first Monday of every month presents an opportunity to boost your deposit by up to €500, depending on your current SlotClub level.

Slot Exchange

As you play games at Slotbox, you earn Coins. Unlike Points, you can exchange these Coins for bonus cash, free spins, and other benefits in the Slot Exchange.

Cashback and Priority Withdrawals

If you’re part of the exclusive Black Diamond level, you’re entitled to even more perks. You’ll receive weekly cashback payments and will be assigned a dedicated account manager who ensures that your withdrawals are processed promptly.

Additional Promotions

SlotClub members should also be on the lookout for special promotions exclusive to the loyalty program. These promotions change monthly and offer additional avenues for rewards.

The SlotClub Loyalty Program adds an extra layer of excitement and reward, making your time at Slotbox Casino even more enjoyable and potentially more profitable.

Weekly Reward Club

Looking for a reason to look forward to the end of the week? Slotbox Casino introduces the Weekly Reward Club, designed to spice up your Fridays and get your weekend off to a winning start.

How It Works:

To participate, you need to wager €25 or more on slot games during the week. Once you meet this requirement, you become eligible for a reward delivered every Friday. The rewards are diverse and lucrative, ensuring something for everyone.

Guaranteed Rewards:

Players who fulfill the wagering requirements are guaranteed to receive at least 10 free spins. But that’s not all; there’s no cap on the amount of bonus cash you can receive, giving you a chance to maximize your gains.

Claiming Your Rewards:

- Ensure you’ve placed bets totaling €25 or more in real money on slots over the past seven days.

- Opt-in to receive notifications through either Email or SMS alerts.

- Log in to your Slotbox Casino account on Friday afternoon to claim your reward.

Additional Requirements:

Players must have more than one deposit to their Slotbox Casino account to qualify for the Weekly Reward Club.

Slotbox Casino No Deposit Bonus

Currently, Slotbox Casino does not offer a no-deposit bonus. However, new players can take advantage of the €1,000 + 100 Free Spins Welcome Package. Stay tuned to Slotbox Casino’s promotional page or opt in for marketing communications to be the first to know when a no-deposit bonus becomes available. This feature allows you to try out the games and experience the casino’s services without committing any funds. Keep an eye on Slotbox Casino’s promotions to make the most of your online gaming experience.

Game Selection at Slotbox Casino

Slotbox Casino delivers a diverse game selection to cater to every type of player. Whether you’re into slots, table games, or live casino action, this platform has something to offer.

Key Highlights:

- A wide array of slots, including popular titles and lucrative progressive jackpots.

- Classic table games like Blackjack and Roulette, among others.

- Live casino options for an immersive, real-time experience.

- Mobile-friendly, allowing you to game on the go.

With a focus on both variety and quality, Slotbox Casino ensures an engaging gaming experience for all players.

Live Casino Experience at Slotbox Casino

For those who crave the excitement of a land-based casino but prefer the convenience of online gaming, Slotbox Casino’s live casino section is the perfect solution. Offering real-time interaction with professional dealers, this feature brings the authentic casino experience right to your screen.

Key Features:

- Hosted by professional dealers for a genuine casino atmosphere.

- Real-time games include popular choices like Blackjack, Roulette, and Poker.

- Seamless streaming quality for an immersive experience.

The live casino at Slotbox provides a compelling blend of traditional gameplay and modern online convenience, promising a thrilling and authentic gaming experience.

Drops & Wins

One of the key highlights in the live casino section is the Drops & Wins feature, presented in collaboration with Pragmatic Play. This feature has a staggering weekly prize pool of €125,000.

With Slotbox Casino’s mobile compatibility, you’re not limited by location. You can enjoy a quality gaming experience wherever you are, right at your fingertips.

Deposit and Withdrawal Options at Slotbox Casino

At Slotbox Casino, the payment methods on offer reflect the casino’s commitment to both security and convenience. With SSL data encryption, all transactions are protected, ensuring your personal information remains confidential and inaccessible to third parties. Slotbox Casino provides an array of reliable payment options, including Visa, MasterCard, Bank Transfer, Skrill, Neteller, EcoPayz, and Bitcoin.

| Withdrawal Method | Min. Withdrawal | Withdrawal Time |

| Visa | €20 | 1-3 business days |

| Mastercard | €20 | 1-3 business days |

| Bank Transfer | €20 | 3-5 business days |

| Skrill | €20 | Under 12 hours |

| Neteller | €20 | Under 12 hours |

| Ecopayz | €20 | Under 12 hours |

| Bitcoin | 0.000072 BTC | Under 12 hours |

Withdrawal requests undergo verification that could take up to two business days, especially if the payments team needs additional time for certain cases. Players can expect their withdrawal to be processed to their preferred payment method after this period. E-wallets and online bank transfers are the fastest withdrawal methods, while card withdrawals and bank transfers usually take 1–3 and 3–5 business days, respectively.

Withdrawal Caps: The maximum amount you can withdraw is €4,000 per day, €16,000 per week, and €50,000 per month.

Fast and Convenient Deposit Methods

For deposits, Slotbox Casino offers instant processing times across all methods. Here are the details:

| Deposit Method | Min. Deposit | Deposit Time |

| Visa | €10 | Instant |

| Mastercard | €10 | Instant |

| Bank Transfer | €10 | Instant |

| Skrill | €10 | Instant |

| Neteller | €10 | Instant |

| Ecopayz | €10 | Instant |

| Bitcoin | 0.000036 BTC | Instant |

Choose your preferred payment method and enjoy the seamless gaming experience that Slotbox Casino has to offer.

Mobile Gaming Compatibility

Whether you’re waiting in line, on a lunch break, or just lounging at home, you can easily access the casino’s wide array of games right from your mobile device.

Key Features:

- No app download required; accessible via mobile browser.

- Full range of games available, from slots to live casino options.

- Optimized for smooth performance on various mobile devices.

Why Choose Slotbox Casino?

Making the right choice in an online casino is crucial for a fulfilling gaming experience. Slotbox Casino stands out as a premium choice, especially for Irish players, for a number of compelling reasons:

- Variety of Games

Slotbox Casino offers an extensive range of games to cater to all kinds of players, from slots and table games to an exciting live casino experience.

- Exceptional Promotions

Take advantage of lucrative promotions, starting with an impressive €1,000 + 100 Free Spins Welcome Package. You’ll also find regular bonuses, from birthday offers for VIP players to weekly rewards.

- Multi-Level Loyalty Program

Become a part of the SlotClub and benefit from a tiered loyalty program that offers everything from LevelUp rewards to cashbacks and priority withdrawals.

- Safety and Security

Licensed in Curacao and operated by Slotbox NV, the casino adheres to strict security measures. All transactions are SSL-encrypted, safeguarding your personal and financial data.

- Flexible Payment Methods

With multiple secure and speedy payment options, including Bitcoin, Slotbox ensures a hassle-free deposit and withdrawal experience.

- Multi-Language Support

Accessibility is key, and Slotbox Casino delivers by offering services in multiple languages, including English, Finnish, German, Japanese, and Norwegian.

- Superior Customer Service

With an approach focused on customer satisfaction, Slotbox provides top-notch customer service, available to assist you with any queries or issues you might have.

Responsible Gambling

- Setting Limits. Control your spending by setting daily, weekly, or monthly deposit limits.

- Self-Exclusion. Take a break from gambling by using the self-exclusion feature to disable your account temporarily or permanently.

- Time-Out Period. Lock your account for specific periods, ranging from 24 hours to six weeks.

- Third-Party Support. Access professional advice through partnerships with external organizations.

- Reality Checks. Receive frequent reminders about your play duration, total bets, and losses.

- Secure Environment. Benefit from stringent security measures, including SSL data encryption.

- Underage Protection. Ensure a safe platform through rigorous age verification procedures.

FAQ

Yes, Slotbox Casino employs SSL data encryption to ensure the safety and security of your transactions and personal information. The casino is licensed in Curacao and operated by Slotbox NV, adhering to strict regulations and guidelines.

To withdraw your winnings at Slotbox Casino, go to your account and select the ‘Withdraw’ option. Choose your preferred withdrawal method and follow the on-screen instructions. The time it takes to process withdrawals depends on your chosen method, ranging from under 12 hours for e-wallets to 1-3 business days for card withdrawals.

If you encounter issues with your welcome bonus, it’s advisable to contact Slotbox customer support for immediate assistance. You can reach them through live chat or by sending a direct email.

As of now, Slotbox Casino hasn’t specified an option for players to set their own deposit limits. If this is a concern for you, you may wish to reach out to customer support for personalized guidance on responsible gambling.

Slotbox Casino offers a comprehensive gaming experience that caters to a wide range of players. From its rich selection of games and live casino options to its enticing promotional offers and robust loyalty program, there’s something for everyone. With secure payment options and a strong commitment to responsible gaming, Slotbox stands as a reliable and entertaining option for online casino gaming. Experience the thrill of Slotbox Casino today!